Some individuals who take out loans only look at the anticipated interest rates and repayment plans when determining loans.Unveiling the Hidden Costs of Loans: What You Should Know Before Borrowing, will guide you through loan journey. This is not the best way to evaluate loans. There are many other things to take into consideration before obtaining one. The loaning process has many intricacies that, without prior knowledge, may result in determining loans that are extremely costly. It is essential to understand the loaning process in order to best evaluate loans and prevent receiving loans that are unnecessary.

With the aim of receiving the highest quality loan, this work will analyze other hidden expenses associated with loans. Other objectives will also include presenting a summary comparing various kinds of loans with a compilation of their hidden expenses, and explaining the ways to examine and assess loan offers.

An Overview of Costs Pertaining to Loans

Before explaining any additional costs that loans may entail, there are a few fundamental things that must be understood regarding loans.

- Overall Amount of Debt: The overall amount of debt that is borrowed.

- Value of Debt: The amount that one must pay in order to borrow the overall amount of debt. This is also considered to be the value of debt.

- Repayment Time: The span of time that is provided in order to pay back the overall debt that is owed.

- Debt Instalments: The amount of debt that is payable in an individual month of a repayment time period.While other aspects get more attention, these particular elements are not all the expenses as mentioned in the agreements. Let us examine some other possible hidden costs that are included in the loan agreements.

Some Other Potential Neglected Costs

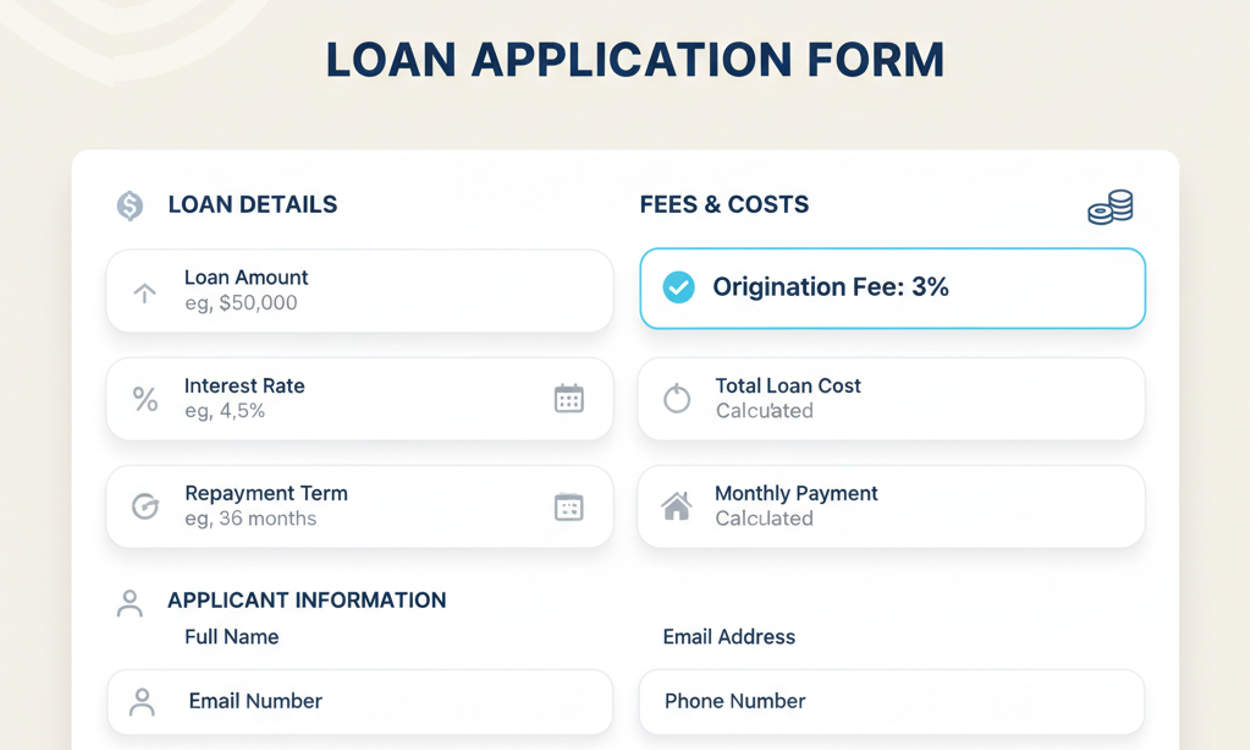

- Origination Fee Perhaps, one of the more common hidden costs that the borrower encounters are the origination fee. These are fees that some lenders assign for the processing of a loan application. Some lenders can assign fees anywhere between 1% to 5% of the total loan amount, depending on the lender and the type of the loan. For example, if the loan is $10,000, and that lender is charging a 3% origination fee, then that is going to cost an additional $300. Advice: If the lender provided a cost breakdown, then this is important to consider when reviewing your loan cost. Placeholder for Image 1 Description for Image: Loan application formed with origination fee indicated in the total amount.

- Prepayment Penalties Certain loans will have what is known as a prepayment penalty, which is a charge some lenders will add if you pay off your loan prior to the agreed date. It may seem strange, but lenders will charge these fees as a way to cover any interest they will lose if the loan is paid off before the end date. Not every loan comes with prepayment penalties, but it is still important to check for these fees when looking at different offers.

Tip: Try to find loan agreements which have prepayment flexibility or have no prepayment penalties all together. - Late Payment Fees Borrowers often focus solely on the on time monthly payments, but they don’t think about the repercussions of not making a payment at all. If you have a due date scheduled and you miss it, the lender can charge you a late payment fee. These fees can range anywhere from $25 to $50, and they can worsen your financial situation by increasing your interest rate or lowering your credit score. Tip: To avoid missing due dates and getting hit with late fees, consider enrolling in automatic payments.

- Annual Fees for Credit Cards

When applying for a credit card, take note of the annual fee if there is one. For some cards, this fee does not apply, but for many high premium credit cards, the fees accrue. These fees can reach $500+ based on the perks of the credit card. Therefore, it is important to know the fee beforehand to determine the net losses of having the card.

Tip: Assess the annual fee alongside the card’s total rewards or benefits. Maybe it is better to take a card with a high annual fee if it cost a lot, but it has many benefits.

- Higher Interest Rates for Poor Credit

It is the case that a borrower with a poor credit score may be given a higher interest rate and that raises the total cost of the loan. This is one of the most severe concealed costs of supposed ‘no cost’ loans because higher interest rates may lead to thousands of dollars of accumulated interest over the lifetime of the loan.

Tip: If you want good terms on loans, you can try to shop around for better loans, and try improving your credit score beforehand.

- Credit Insurance

Some creditors require or voluntary offer credit insurance, which pays off your loan in case you lose your job or become disabled or die. Although this may seem like a good safety net, it often has hefty premiums, which can over time, increase the loan cost significantly.

Tip: For these types of insurance, check the optionality and compare the pricing of it purchased separately or from the loan provider.

Comparing Loan Types: Which is Best For You?

The potential costs involved in common loan types will then help you understand the cost of hidden costs and how it varies in different types of loans in the comparison table below.

Prepayment Penalty

| Loan Type | Interest Rate | Origination Fee | Prepayment Penalty | Late Payment Fee | Annual Fees | Credit Insurance |

| Personal Loan | 5% – 36% | 1% – 5% | Possible | $25 – $50 | N/A | Optional |

| Auto Loan | 3% – 10% | 0% – 3% | Possible | $25 – $50 | N/A | Optional |

| Mortgage Loan | 3% – 7% | 0% – 1% | Possible | $25 – $50 | N/A | Optional |

| Credit Card | 15% – 25% | N/A | N/A | $25 – $40 | $25 – $500 | Optional |

| Student Loan | 3% – 8% | N/A | N/A | $25 – $40 | N/A | Optional |

This table provides a snapshot of customer service reps offer when comapring different loans and loans types. Remember that while some fees are unavoidable such as late or origination fees, others can often be negotiated or avoided entirely.You can compare loans here also

Strategies for Avoiding Hidden Costs of Loans

Luckily, with the information you’ve gathered, you can use these suggestions to help reduce the hidden cost of loans.

- Review All Documents Thoroughly: Review your loan documents closely to understand the full agreement before signing. Make sure you’re mindful of the documents for hidden details or over the stipulated fine print.

- Lender Comparison: Don’t accept the first loan offer you receive, analyze different lenders for better loans for your situation.

- Terms Negotiation: If you can, you should try to negotiate with the lender to omit the origination and late payment fees as they can add up.

- Early Loan Repayment: Try to pay off the loan sooner if your loan agreement does not have a penalty for prepayment, as it will save you money over the course of the loan.

- Credit Score Awareness: Maintaining positive credit activity will help lower your interest rates. This can positively save you money over the life of the loan.

Conclusion

Always remember that when you are taking a loan or applying for a credit card, you should also consider other things, other than the interest rate and the monthly payment that you are required to make. Look for additional and hidden costs such as origination fees, credit insurance, late payment fees, and other things that could financially bite. Look for other options as there is a large diversity out there, and take time to see the whole picture.

If you do the things that are suggested in this article, you will have knowledge and the best of luck for getting the best deal that is out there when you take a loan. If it is a credit card or other kinds of loans such as personal loans or auto loans, remember that you should have knowledge of the situation at hand. With the best tools at your disposal, you will have the ability to borrow money in a way that costs you the least amount in other fees along the way.

https://1024terabox.com/s/10ZVBHFegb_c9bdAUEo9u4g