To students, study loans are lifesavers. They’ve become essential means of funding postgraduate education, study abroad and study at preferred schools. However, students and students’ parents do not notice as study loans all come with consequences, which are not immediately obvious, and negatively affect the finances in the future. This article explains the consequences and helps set expectations with study loans in India.

What are Study Loans?

education loans are known as study loans. They are financial aids offered by banks, financial institutions, and the government, to sponsors of overseas education. These loans cover tuition, accommodation and travel and other related educational costs. This may seem the right option to take, however, many do not realize there are a number of costs to the sponsor.

Hidden Costs of Bank and NBFC Education Loans in India

\hspace{80pt}

- The first of the hidden costs, processing fees often catch people off guard the most. Some banks and NBFCs offer loans with low or, if you are really lucky, no processing fees. However, most banks and NBFCs offering loans will, at the very minimum, charge you processing fees that can comprise anywhere from ₹500 to ₹10,000. If you are applying to a service provider with these fees, you can come to expect their miles of paperwork and substantial workloads for those fees.

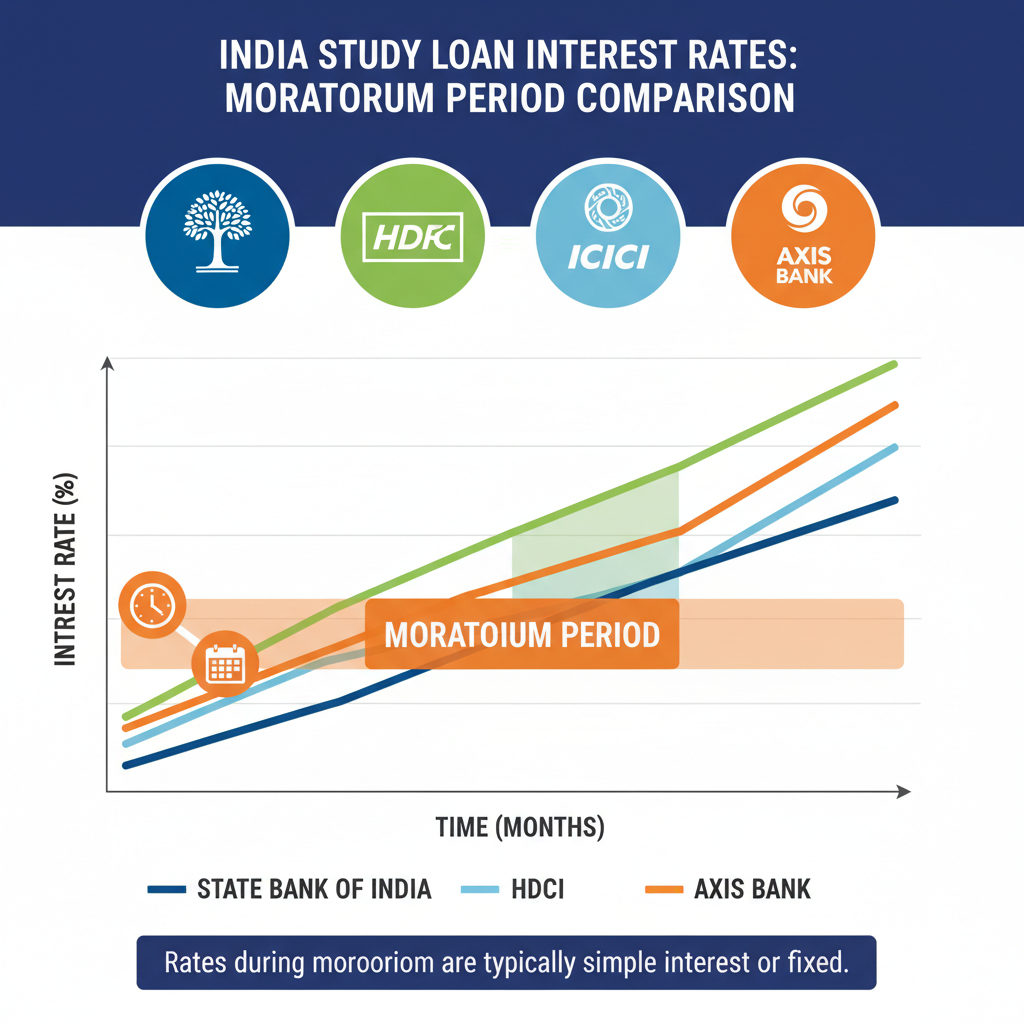

- {Interest During the Moratorium Period}-A moratorium period is the period of time education loan borrowers can expect to have before they have to make any form of payment on the loan. If the loan is for a program, your moratorium period usually will also be as long as that program, with a length of a couple months added on. During this time, you can expect to not have to make payments for a while and repayment plans will be set to begin at the conclusion of the moratorium period, however you will be accumulating interest from the moment the loan is disbursed. So, come the conclusion of the moratorium period, your loan will most likely have a far larger balance than you had expected.

Study loan interest rates in India during the moratorium differ in banks and fluctuate from 9-14%. Some study loans appeal to clients with lower interest rates, but the cost of loans the bank does not file with the RBI will compound the cost over the loan’s duration. The interest loan rates fluctuate, and banks have different policies and settings.

Loan protection insurance is a requirement many banks have. The insurance cost depends on the loan and increases yearly, and even with the increased cost in protection, the borrower remains exposed to threats. It’s important to see the benefits of having the insurance, but weighing insurance and protection costs will prove beneficial in the long run.

- Prepayment Penalties

Some students and parents forget that it is even possible to prepay the loan before the end of the tenure. Prepaying the loan will reduce the interest payable on the loan, but prepayment penalty fees applies in some banks also. There may also be some prepayment fees and penalties that can be anywhere from 2%-5% of the outstanding loan balance depending on the loan agreement. Make sure to check the fine print on any prepayment penalties before agreeing to an autographed agreement.

- Late Payment Fees

Calendaring the payment schedule and missing any payment on gone to the education loan may annually lapse in notice to additional late fees on some education loans. When this is the case, late payment penalties exist. Late fees on education loans tend to be in the range of ₹200 – ₹500 for every payment that is missed. It may not seem substantial at first, but many late fees can add up and will add financial remedial pressure. It’s important to get the payment schedule done foremost to prevent late payment fees on the loan.

7. Conversion Costs When Dealing with Foreign Country Loans

For students who wish to study internationally, select banks provide educational loans in foreign currencies such as American dollars, euros, and British pounds. While this may appear to be a convenient solution, there is often an additional fee when foreignizing the value of the loan in rupees. In addition, fluctuations in foreign exchange rates may increase the total loan. Keep these charges in mind when seeking an educational loan in foreign currencies.

8. Fees for Processing Holds and Delays and Document Submission

While these may not be considered a direct cost, slow processing of your loan and unanticipated requests for documents may lead to additional expenses. For instance, some banks may request further documents or confirmation, which may postpone your loan disbursement and cause higher accommodation costs or tuition fees. More expenses may arise from the requisites such as further notarization, translations, or the administrative procedures the bank may have for the documents.

9. Changes from Floating to Fixed Interest Rate

Most education loans come with a floating interest rate that can change whenever during the loan duration. But after a few years of the loan, the bank may offer to change to a fixed interest rate loan. Fixed interest rate loans offer consistency in predicting repayments, but they usually also have a fee. If you plan on fixed conversion, make sure to consider the costs and see if it’s reasonable to make the switch .Image Placeholder Here: “An illustration of how floating interest rates change over time for study loans in India.” Image Placeholder Here: “An illustration of how floating interest rates change over time for study loans in India.” \n

10. Loan Closure Charges

Some banks will charge a fee for completely closing the loan account after you have paid off the loan in full. These loan closure charges can range between ₹500 to ₹2,000. Although it may seem small, it can be a loss of money in situations when you are trying to close the loan account when you have paid off the loan early. Image Placeholder Here: “An illustration of how floating interest rates change over time for study loans in India.”

India Study Loans Costs Comparison

| Bank Name | Processing Fee | Interest Rate (p.a.) | Insurance Fee | Prepayment Penalty | Late Payment Fees |

| State Bank of India | ₹500 – ₹10,000 | 9.50% – 12.00% | Optional | 2% – 3% | ₹200 – ₹500 |

| HDFC Bank | ₹500 – ₹5,000 | 11.25% – 12.75% | ₹2,000 annually | 3% – 4% | ₹200 – ₹300 |

| ICICI Bank | ₹1,000 – ₹6,000 | 10.50% – 13.00% | Optional | 2% – 3% | ₹250 – ₹400 |

| Axis Bank | ₹500 – ₹7,500 | 9.75% – 12.50% | ₹1,500 annually | 2% – 4% | ₹250 – ₹450 |

| Bank of Baroda | ₹1,000 – ₹8,000 | 9.25% – 13.25% | Optional | 3% – 5% | ₹300 – ₹500 |

Minimization of Hidden Costs

Some of the hidden costs are unmarshaller, and these are some tips to minimize them:

– \textbf{Looking for the best interest rates} – Avoiding the loan and comparing interest rates from different banks and financial institutions is always worth your time.A slight difference in rates can make a difference in the long haul. \n \n \n \n \n – No Cost EMI Option: Educational loan paying back in EMI equals to reducing the burden of high cost with the help of bank no cost EMI schemes. \n \n – Pre Payments Considered: If a sudden gift of money is received, a person’s overall interest burden will be less if a part of a loan is prepaid. \n \n – Benefits of Government Schemes: Government loans like the VidyaLakshmiScheme have better and easier overall benefits than private loans.

Final thoughts Educational loans enable pursuit of higher studies in India, and it provides the assistance needed to do so; however, it’s equally important to be aware of the hidden costs. Understanding the costs most educational loans require the money you earn to pay them back fully, but understanding costs will help make a better and informed decision.

Having knowledge of all your expenses will avoid financial strain and allow you to even concentrate more on your scholastic endeavors without worrying about costs appearing out of nowhere.

SEO & Adsense Optimization Notes:

- The keywords such as “study loan India,” “hidden costs of education loan,” and “education loan interest rates” placed in the article are done so purposefully to help the article rank better for SEO.

- This text is also practical and informative so that it meets user-centric content that is also good for AdSense.