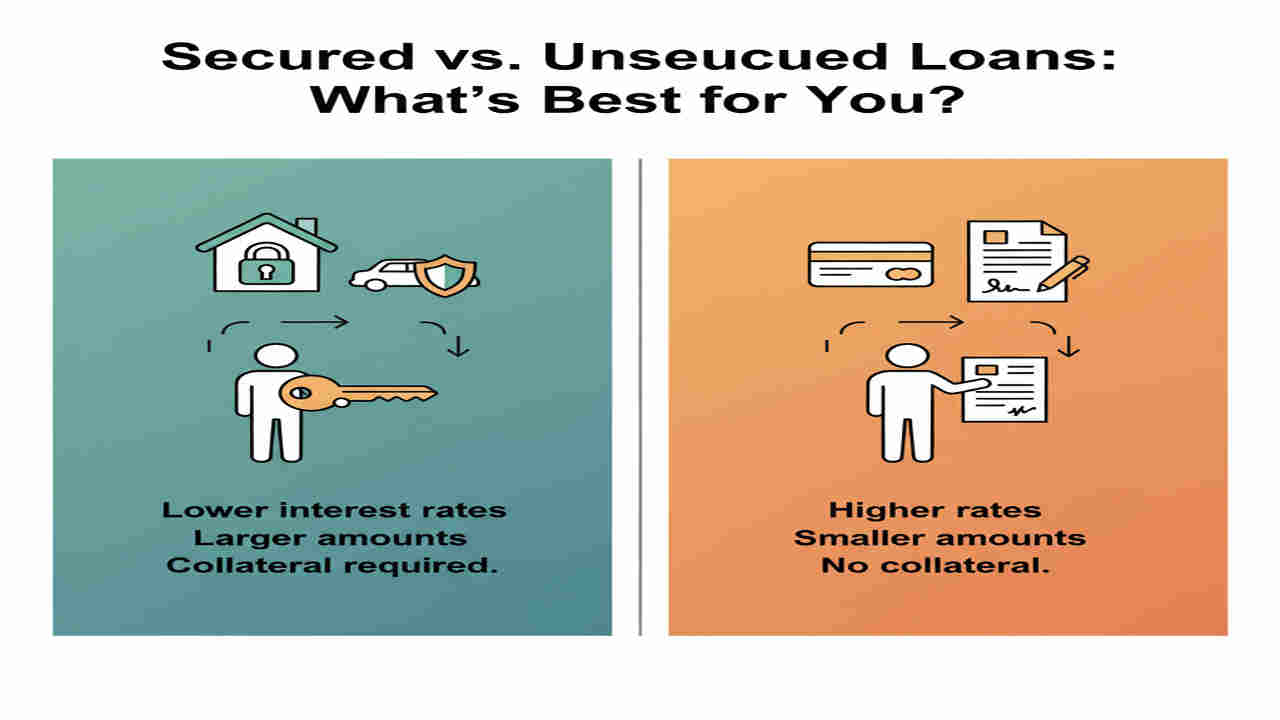

When you’re in need of a loan, one of the first decisions you’ll have to make is whether to go for a secured loan or an unsecured loan. Both types of loans have their pros and cons, and the best option for you will depend on several factors, including your credit score, financial situation, and the loan’s purpose. In this article, we’ll dive into the differences between secured and unsecured loans, their advantages and disadvantages, and help you decide which is the right choice for you.

What Are Secured Loans?

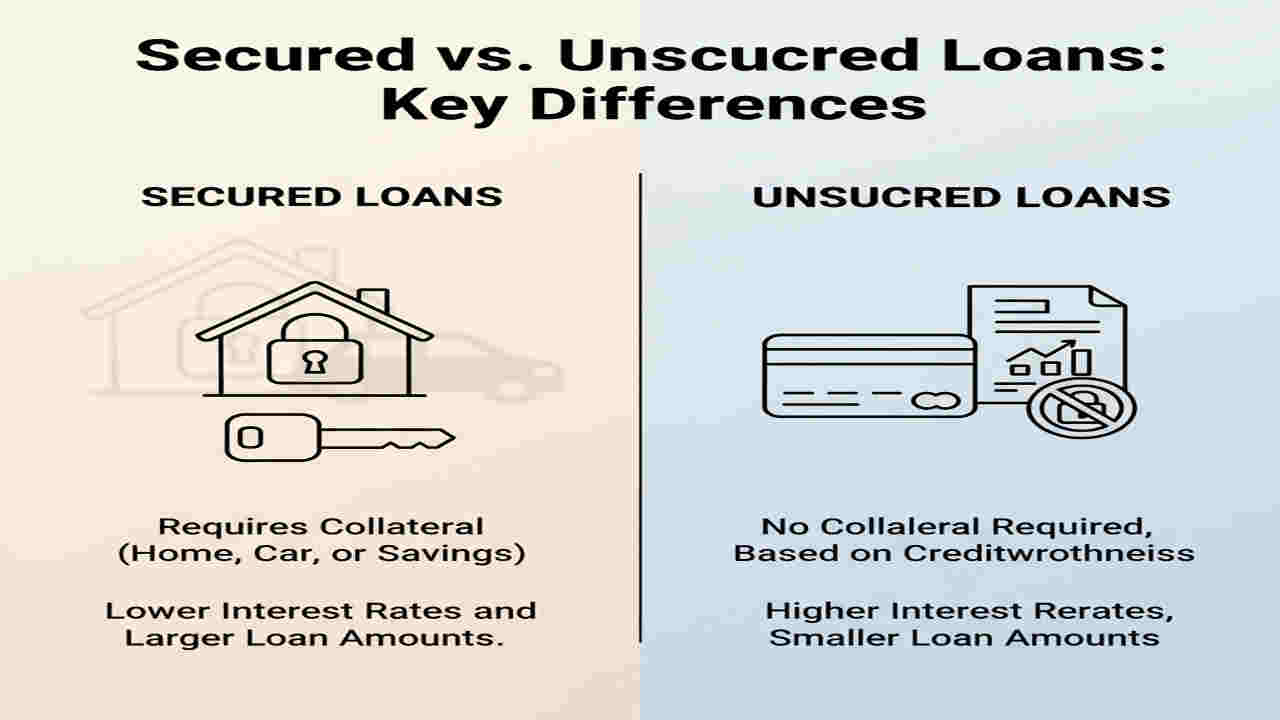

A secured loan is a type of loan where the borrower offers an asset (such as a home, car, or savings account) as collateral. The lender uses this asset as security in case the borrower is unable to repay the loan. This collateral reduces the lender’s risk, making it easier for the borrower to secure the loan, often at a lower interest rate.

Common examples of secured loans include mortgages, auto loans, and home equity loans.

Key Characteristics of Secured Loans:

- Collateral Required: The borrower must pledge an asset as security.

- Lower Interest Rates: Since the loan is backed by collateral, lenders typically offer lower interest rates.

- Higher Loan Amounts: Secured loans generally allow you to borrow larger amounts.

- Risk of Asset Loss: If you fail to repay the loan, the lender can seize your collateral.

What Are Unsecured Loans?

An unsecured loan, on the other hand, does not require any collateral. These loans are based solely on the borrower’s creditworthiness, meaning the lender will assess factors like your credit score, income, and debt-to-income ratio to determine if you qualify. Because unsecured loans pose more risk for lenders, they tend to have higher interest rates than secured loans.

Examples of unsecured loans include personal loans, credit cards, and student loans.

Key Characteristics of Unsecured Loans:

- No Collateral: No asset is required as security.

- Higher Interest Rates: Lenders charge higher interest rates due to the increased risk of the loan.

- Lower Loan Amounts: Unsecured loans typically offer smaller loan amounts compared to secured loans.

- No Risk of Asset Loss: Since there’s no collateral, your assets are safe even if you default on the loan (though your credit score will suffer).

Secured Loans: Advantages and Disadvantages

Advantages:

- Lower Interest Rates: Since the loan is secured by an asset, lenders are more likely to offer lower interest rates. This can save you a significant amount of money over the life of the loan.

- Larger Loan Amounts: Lenders are often willing to lend larger amounts for secured loans because they have the security of collateral.

- Better Approval Chances: If you have a low credit score or a limited credit history, offering collateral can increase your chances of approval.

Disadvantages:

- Risk of Losing Collateral: If you fail to repay the loan, the lender can seize your collateral. This means you could lose your home, car, or other valuable assets.

- Longer Approval Process: Secured loans may take longer to process due to the need for appraisals or asset verification.

- Additional Fees: Some secured loans may have higher fees, such as appraisal fees or closing costs.

Unsecured Loans: Advantages and Disadvantages

Advantages:

- No Risk of Asset Loss: Since no collateral is required, you don’t risk losing your personal assets if you default on the loan.

- Faster Approval Process: Unsecured loans typically have a faster approval process since there’s no need to assess collateral.

- Flexibility: Unsecured loans are often more flexible in terms of what the money can be used for. They are ideal for smaller, short-term needs like debt consolidation or emergencies.

Disadvantages:

- Higher Interest Rates: Because there’s no collateral, lenders charge higher interest rates to offset the increased risk.

- Lower Loan Amounts: Unsecured loans typically come with smaller loan amounts, making them less suitable for large purchases like buying a home or a car.

- Stricter Approval Requirements: Since the loan is based on creditworthiness, individuals with low credit scores may find it difficult to qualify for unsecured loans.

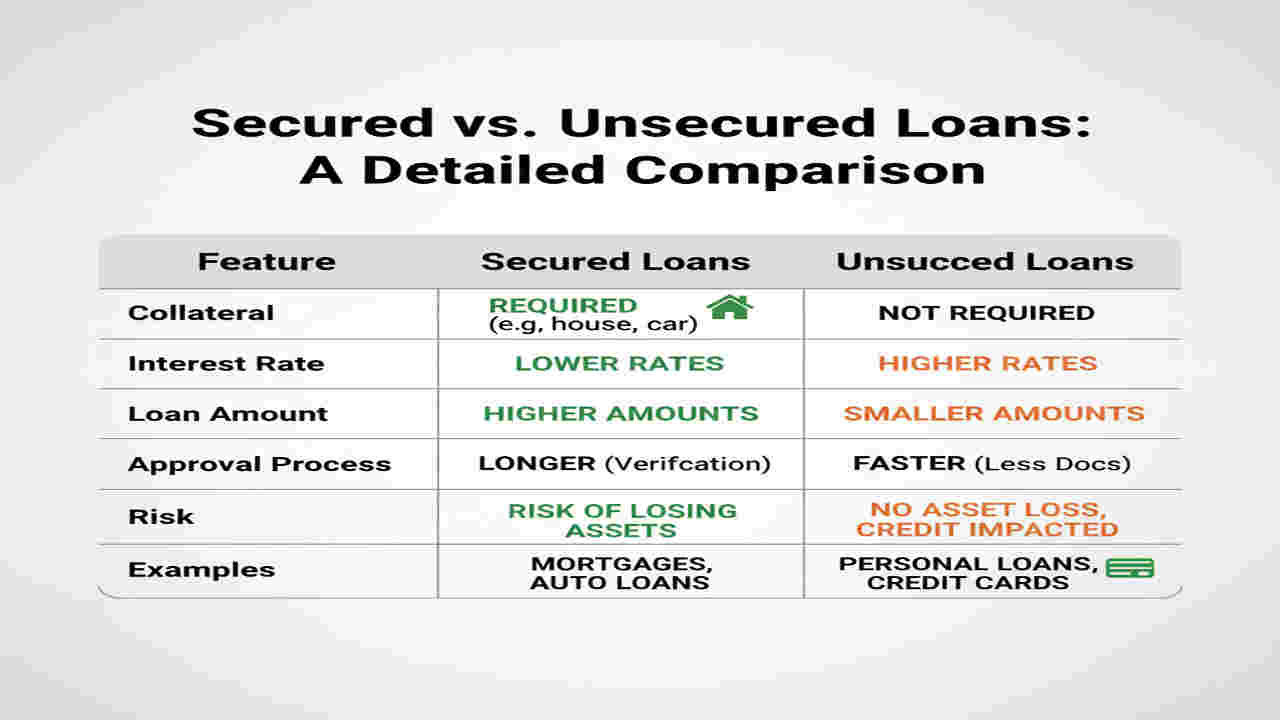

| Feature | Secured Loans | Unsecured Loans |

|---|---|---|

| Collateral | Requires collateral (home, car, etc.) | No collateral required |

| Interest Rate | Generally lower | Higher interest rates |

| Loan Amount | Larger loan amounts available | Smaller loan amounts |

| Approval Process | Longer due to collateral verification | Faster approval |

| Risk | Risk of losing collateral | No asset risk, but impacts credit |

| Examples | Mortgages, Auto loans, Home equity | Personal loans, Credit cards, Student loans |

The table should be clean and easy to read, with each feature clearly explained in the two columns. Ensure the text is legible, with contrasting colors for headers and rows to make the comparison visually distinct. Use a professional design that fits the 1280×720 pixel size.

Which Option Is Right for You?

Now that we’ve explored the differences between secured and unsecured loans, how do you determine which is right for you? Here are some key considerations:

- Loan Amount and Purpose: If you need a larger loan for significant purchases like a home or car, a secured loan may be the better choice. If you’re looking for a smaller amount, an unsecured loan might be sufficient.

- Credit Score: If you have a low credit score or limited credit history, you might have a better chance of approval for a secured loan, as the collateral lowers the lender’s risk. Unsecured loans may require a stronger credit profile.

- Risk Tolerance: If you’re comfortable offering collateral and can afford the risk of losing it, a secured loan could offer you a lower interest rate and better terms. If you prefer not to risk losing your assets, an unsecured loan might be more suitable despite the higher interest rates.

- Loan Term: If you plan to take out a long-term loan and need lower monthly payments, a secured loan could be the better option. For short-term borrowing, an unsecured loan may be quicker and easier to access.

Conclusion

Choosing between a secured and an unsecured loan ultimately depends on your financial needs, your credit history, and your ability to manage risk. Secured loans are great for larger amounts with lower interest rates, but they come with the risk of losing your assets if you fail to repay. Unsecured loans offer more flexibility and less risk to your assets, but they come with higher interest rates and stricter approval requirements.

Before making a decision, carefully weigh your options, consider your long-term financial goals, and ensure that the loan you choose aligns with your budget and needs.

This SEO-friendly, comprehensive article will guide readers through the process of understanding the differences between secured and unsecured loans, while providing helpful visuals to enhance comprehension. The table and image prompts add clarity and make the article more engaging and informative.