When you take out a loan, whether it’s for a home, car, or education, you agree to repay the borrowed amount over a set period. But how exactly do lenders determine your monthly payments? What happens if you pay early or miss a payment? All of this boils down to one important concept: loan amortization. In this article, we will explore what loan amortization is, how it works, and how it affects your repayment schedule.

What is Loan Amortization?

Loan amortization refers to the process of spreading out a loan into a series of fixed payments over time. Each payment is divided into two parts: one part goes toward paying the interest on the loan, and the other part goes toward reducing the principal balance. The primary goal of amortization is to ensure that the loan is fully paid off by the end of the term.

Amortization is particularly common with mortgages, car loans, and personal loans, where regular, equal payments are made over a period of time (usually monthly). Understanding how amortization works can help you plan better and manage your finances efficiently.

How Loan Amortization Works

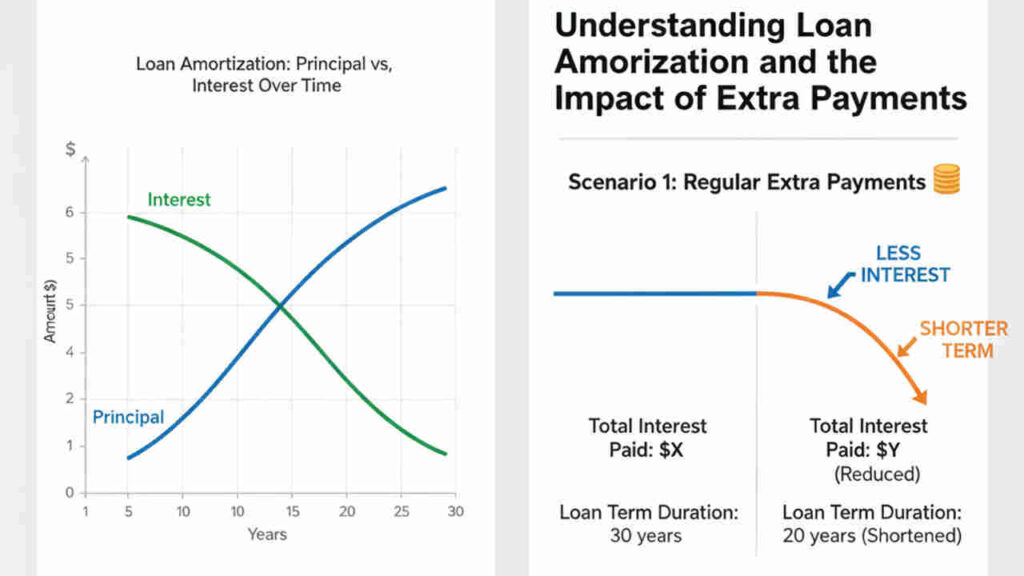

At the beginning of the loan term, your payments are mostly applied to interest. As you continue to make regular payments, a larger portion of each payment starts going toward reducing the principal. This is because the amount of interest you owe decreases as the loan balance decreases.

Key Components of Amortization:

- Principal: The original loan amount that you borrowed.

- Interest: The cost of borrowing money, typically expressed as an annual percentage rate (APR).

- Loan Term: The length of time you have to repay the loan, typically 15, 20, or 30 years for mortgages.

- Monthly Payment: The fixed amount you pay each month toward your loan, which covers both principal and interest.

- Amortization Schedule: A table that shows each loan payment over the term, breaking down how much goes toward interest and how much reduces the principal.

The Amortization Schedule Breakdown

A loan amortization schedule is a detailed table that shows each payment’s allocation to the principal and interest over time. For example, in a 30-year mortgage, the first few years will consist mostly of interest payments, with a small portion of your payment going toward the principal. As time progresses, more of each payment is applied to the principal.

Below is an example of an amortization schedule for a hypothetical loan. We’ve created a comparison table to make it easier to understand how the portions of your payments change over time.

| Payment # | Payment Amount | Principal Paid | Interest Paid | Remaining Balance |

|---|---|---|---|---|

| 1 | $1,000 | $200 | $800 | $99,800 |

| 2 | $1,000 | $202 | $798 | $99,598 |

| 3 | $1,000 | $204 | $796 | $99,394 |

| 4 | $1,000 | $206 | $794 | $99,188 |

| 5 | $1,000 | $208 | $792 | $98,980 |

This table shows how your monthly payments initially cover more interest than principal. Over time, the interest portion decreases, and the principal portion increases. By the end of the loan term, the remaining balance will be paid off.

Factors Affecting Loan Amortization

There are several factors that can affect your loan amortization schedule. These factors determine how fast you pay off the loan, how much interest you pay in total, and the overall cost of the loan.

- Loan Term: A longer loan term means smaller monthly payments, but it also means you’ll pay more in interest over time. Conversely, a shorter loan term means higher monthly payments but less total interest.

- Interest Rate: The higher the interest rate, the more of your monthly payment will go toward interest, especially in the early years of the loan. A lower interest rate means more of your payment will go toward reducing the principal.

- Loan Type: Fixed-rate loans have a consistent monthly payment throughout the term, while adjustable-rate loans may have fluctuating payments. This affects how your payments are split between interest and principal.

- Extra Payments: Making extra payments, such as lump sums or bi-weekly payments, can help reduce your principal faster, thereby decreasing the interest you pay over the life of the loan. This can shorten the loan term significantly.

Benefits of Understanding Loan Amortization

- Better Financial Planning: Knowing how your payments are structured can help you plan your finances more effectively. For example, you can anticipate when your principal balance will decrease and adjust your savings or investments accordingly.

- Interest Savings: By making extra payments, you can reduce your interest costs and pay off your loan earlier. This can result in significant savings over the life of the loan.

- Loan Comparisons: Understanding amortization allows you to compare different loan offers. You can choose the loan that best suits your financial situation, whether you’re looking for lower monthly payments or a quicker repayment plan.

- Debt Management: If you’re dealing with multiple loans, knowing how amortization works can help you prioritize payments, especially if you want to pay off high-interest loans first.

Loan amortization is a crucial concept to understand when taking out any kind of loan. It’s not just about making monthly payments—it’s about knowing how those payments are applied and how they affect the loan balance over time. By understanding your loan amortization schedule, you can make more informed decisions about repayment strategies, whether you’re aiming to save money on interest or pay off the loan faster.

If you plan to take out a loan, make sure to ask your lender for an amortization schedule. Use this schedule to track your payments and determine the best course of action for your financial goals.