When taking out a loan, many people focus on the interest rate, loan term, and monthly payments. While these are important factors, there’s one crucial aspect that is often overlooked—hidden fees. These fees can significantly increase the cost of borrowing and affect your ability to repay the loan. Understanding these hidden charges is vital before committing to any loan agreement.

In this article, we will walk you through common hidden fees in loans, how to spot them, and how they can impact your finances. By the end, you’ll be better prepared to avoid costly surprises.

What Are Hidden Fees?

Hidden fees are charges that are not clearly disclosed or are tucked away in the fine print of your loan agreement. These fees are often small on paper, but they can quickly add up and lead to unexpected costs that can strain your budget. In many cases, borrowers only realize these fees after the loan has been approved or when the first payment is due.

Common Hidden Fees in Loans

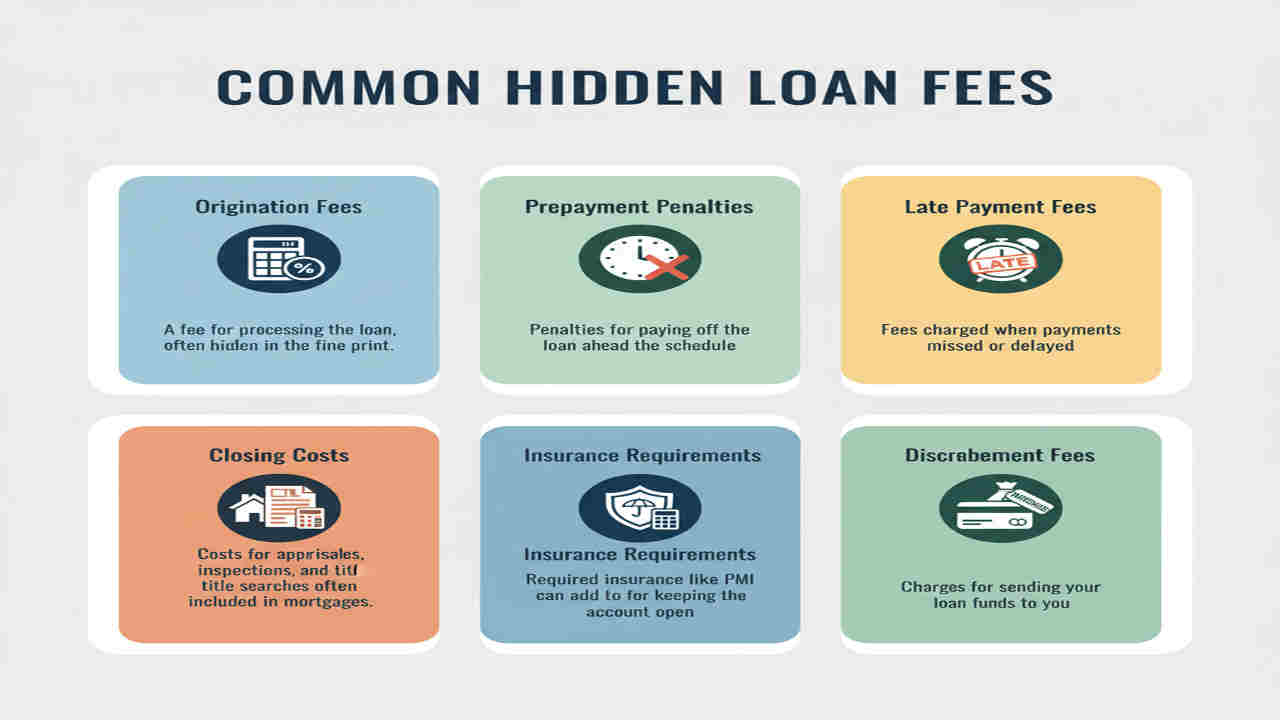

Here are some of the most common hidden fees to watch out for when applying for a loan:

1. Origination Fees

Many lenders charge an origination fee for processing a loan. This fee covers the cost of evaluating and approving the loan application. It is usually a percentage of the total loan amount and can range from 1% to 5%. While some lenders include this fee upfront, others may bury it in the loan’s terms, making it less obvious.

2. Prepayment Penalties

Some loans come with prepayment penalties, which are fees charged if you pay off the loan early. This fee is designed to protect the lender’s interest in the loan, as they may lose out on potential interest earnings if the loan is paid off early. Prepayment penalties are common with mortgages and auto loans but can also apply to personal loans.

3. Late Payment Fees

Late payment fees are another common hidden cost. If you miss a payment or pay after the due date, the lender may charge a penalty. While these fees are often outlined in the loan agreement, many borrowers overlook them, leading to unnecessary charges. Late fees can also damage your credit score if they are reported to the credit bureaus.

4. Closing Costs

For mortgages and home equity loans, closing costs are a significant expense that often goes unnoticed until the loan is finalized. These costs include fees for appraisals, inspections, title searches, and other services necessary to complete the loan process. While the lender is required to provide an estimate of these costs, they may still vary at the time of closing.

5. Insurance Requirements

Some loans, particularly mortgages, require you to purchase insurance. This can include private mortgage insurance (PMI), which is typically required if you are unable to make a down payment of at least 20%. While this fee is often disclosed, the total cost of insurance can be hidden within the monthly payments, making it hard to spot until the bill arrives.

6. Disbursement Fees

Some lenders charge a disbursement fee for sending the loan funds to you. This fee is often a flat fee or a small percentage of the total loan amount. It is usually charged at the time the funds are released, so it may not be immediately apparent when you first apply for the loan.

7. Account Maintenance Fees

Certain loans come with account maintenance fees, particularly in the case of lines of credit or revolving loans. These fees can be charged monthly or annually for maintaining the loan account. They may not be mentioned clearly, so it’s essential to read the loan terms carefully.

How Hidden Fees Affect Your Loan

It’s easy to overlook these hidden fees, especially when lenders advertise “low interest rates” or “no fees.” However, these fees can have a significant impact on the total cost of your loan. Let’s take a closer look at how these charges can affect your finances.

1. Increased Loan Cost

Even a small origination fee can add hundreds or even thousands of dollars to the total cost of your loan. For example, a $10,000 loan with a 3% origination fee would cost you an additional $300. When added to the interest, the total cost of the loan can increase substantially.

2. Higher Monthly Payments

Some fees, like insurance requirements and account maintenance fees, can be included in your monthly payment. Over the life of the loan, this can lead to higher monthly expenses. For instance, PMI can add hundreds of dollars to your mortgage payment each month.

3. Unnecessary Penalties

Prepayment penalties are designed to discourage you from paying off your loan early. However, if you do manage to pay off your loan ahead of schedule, you could be hit with a hefty fee. This discourages many borrowers from paying off their debt quickly, leaving them stuck with longer repayment terms and more interest to pay.

4. Damage to Your Credit Score

Late payment fees can harm your credit score if they lead to missed payments. Even if you pay on time, the extra fees can make it more difficult to stay on top of your finances, increasing the risk of missing payments in the future.

How to Avoid Hidden Fees

Now that you know what to look for, here are some tips for avoiding hidden fees in loans:

1. Read the Fine Print

Before signing any loan agreement, take the time to thoroughly read all the terms and conditions. This includes understanding all fees, charges, and penalties. Don’t hesitate to ask the lender to clarify any fees you don’t understand.

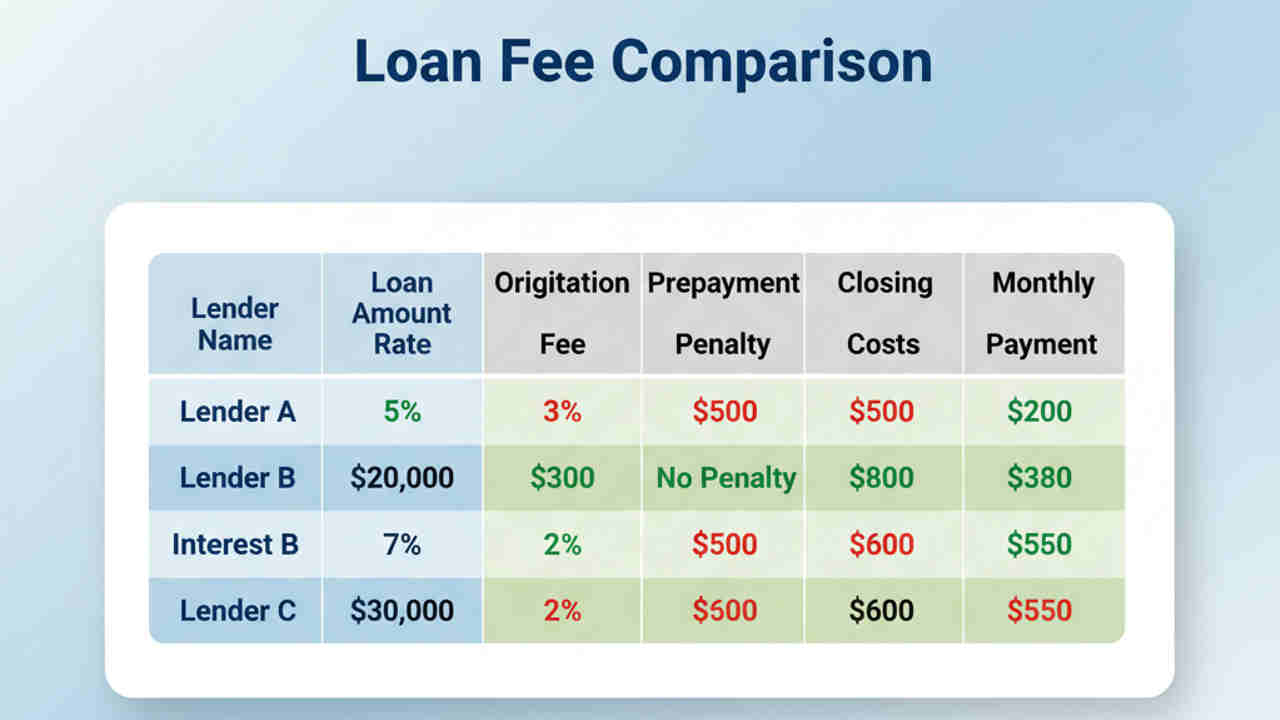

2. Compare Lenders

Different lenders may have different fee structures. When shopping for a loan, compare offers from multiple lenders to find the one with the most favorable terms. Be sure to ask about any hidden fees that may not be immediately obvious.

3. Negotiate Terms

In some cases, you may be able to negotiate the removal or reduction of certain fees, such as origination fees or prepayment penalties. It never hurts to ask, especially if you have a strong credit history.

4. Consider Alternative Loans

Some alternative lenders, such as credit unions, may offer loans with lower fees or more favorable terms. If you’re struggling with high fees from traditional lenders, it might be worth exploring these options.

Conclusion

Hidden fees in loans can catch borrowers off guard and end up costing more than expected. From origination fees and prepayment penalties to closing costs and account maintenance fees, it’s essential to understand what you’re signing up for. By carefully reviewing your loan agreement, comparing offers, and negotiating terms, you can avoid many of these hidden fees and make a more informed decision about your loan.

Remember, a low interest rate doesn’t always mean a good deal. Take the time to consider all costs associated with a loan, and you’ll be in a better position to choose the best option for your financial future.

This SEO-friendly, detailed article provides valuable insights into the often-overlooked hidden fees in loans. By addressing common fees, how they affect your finances, and how to avoid them, you can help readers make more informed decisions and save money in the long run.