Education is one of the most significant investments a student can make in their future. However, the rising cost of higher education in India has made it increasingly difficult for students to manage tuition fees and other expenses. That’s where student loans come in, helping bridge the gap between education and affordability. In this comprehensive guide, we’ll walk you through everything you need to know about student loans in India in 2026, including how they work, eligibility criteria, available options, and a detailed comparison of different loan providers.

What is a Student Loan?

A student loan is a financial product that helps students pay for their education expenses. The loan amount can cover tuition fees, hostel charges, books, and other study-related expenses. Student loans are generally provided by banks, financial institutions, and government schemes, often with lower interest rates and deferred repayment options.

In India, student loans can be availed for undergraduate, postgraduate, and even vocational courses. The terms and conditions of the loan can vary based on the loan provider, the course of study, and whether it is a domestic or foreign institution.

Types of Student Loans in India

Before you apply for a student loan, it’s essential to understand the different types available. These include:

- Education Loans for Domestic Studies

- These loans are offered for studies at recognized institutions within India. They are the most common type of student loan, with banks providing financial support for a wide range of courses.

- Education Loans for Foreign Studies

- These loans are specifically designed for students who wish to study abroad. The loan covers the entire cost of studying overseas, including tuition fees, living expenses, and travel.

- Government-Sponsored Student Loans

- The Indian government offers subsidized loans through schemes like the Vidya Lakshmi Portal and various public sector banks. These loans usually have lower interest rates and flexible repayment options.

- Personal Loans for Education

- If you’re unable to get an education loan, you might consider a personal loan. Though these loans come with higher interest rates, they may still help in financing your education.

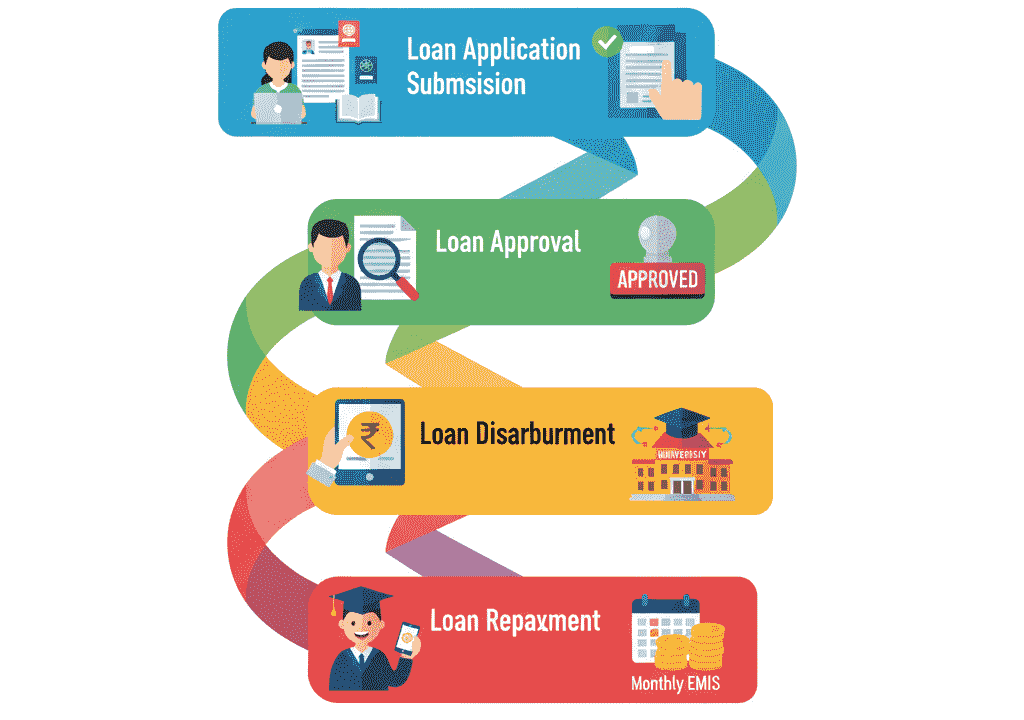

How Do Student Loans Work?

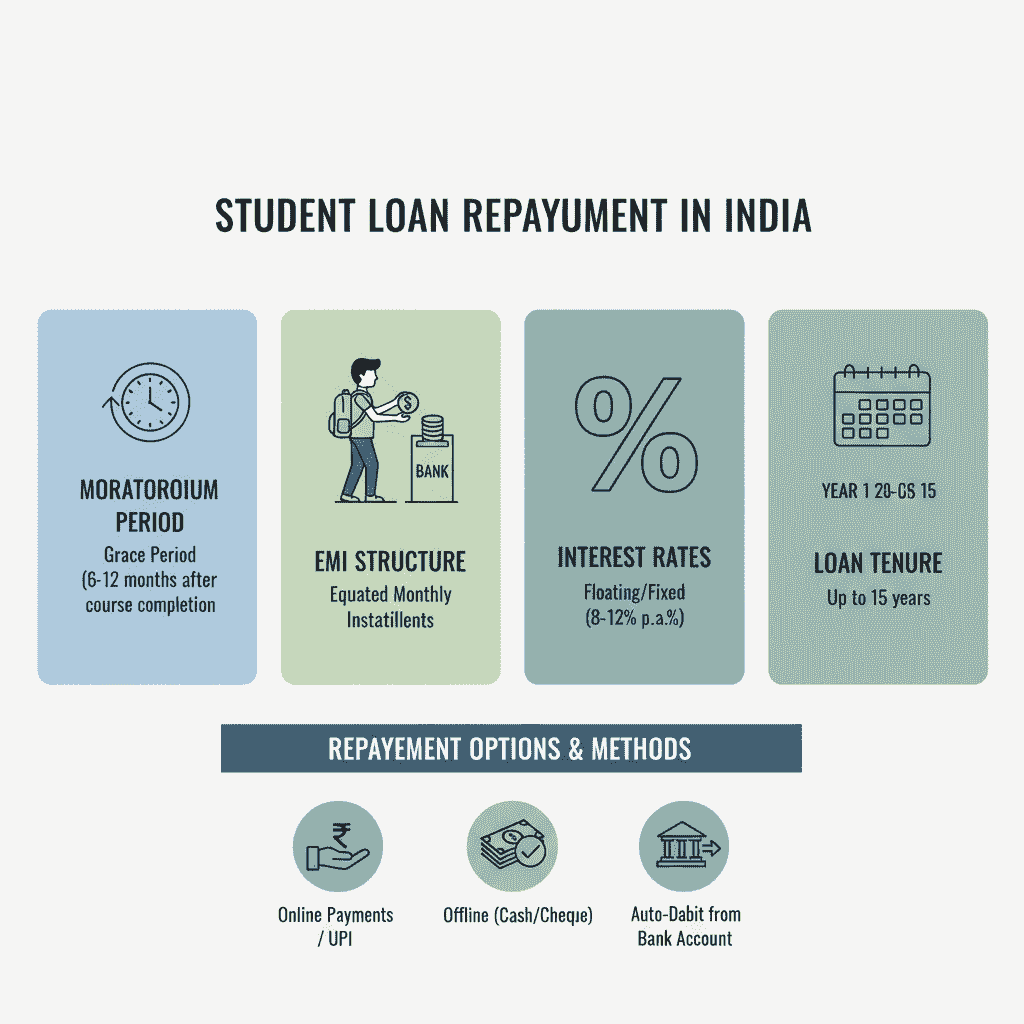

Student loans are typically provided with a repayment holiday. This means that the borrower doesn’t have to begin repaying the loan immediately after receiving it. The repayment period starts after a moratorium period, which usually lasts six months to a year after completing the course. Here’s how it works in a nutshell:

- Loan Application

- You begin by applying for a loan with your preferred lender. You’ll need to submit documents such as your admission letter, academic records, and proof of identity.

- Approval and Sanction

- The bank or financial institution reviews your application and, if approved, sanctions the loan. You’ll receive a sanction letter outlining the loan amount, interest rate, tenure, and other terms.

- Loan Disbursement

- Once the loan is sanctioned, the amount is disbursed directly to the educational institution or to your account, depending on the loan terms.

- Repayment

- After the completion of your course, you start repaying the loan, which can span anywhere from 5 to 15 years, depending on the loan agreement.

Eligibility Criteria for Student Loans in India

Eligibility for a student loan depends on several factors such as the course you’re pursuing, your credit history, and your academic record. Here are some basic eligibility requirements for student loans in India:

- Indian Nationality: The applicant must be an Indian citizen.

- Admission to a Recognized Course: The student must have secured admission to a recognized college or university.

- Age Limit: Most lenders require the applicant to be at least 18 years old, with some lenders providing loans to students up to the age of 35.

- Co-Applicant Requirement: Most student loans require a co-applicant, usually a parent or guardian, who will be responsible for repaying the loan in case the student defaults.

- Course Type: Loans are typically available for undergraduate, postgraduate, and professional courses. Some lenders may also provide loans for diploma courses or vocational training.

Key Factors to Consider Before Applying for a Student Loan

Before you apply for a student loan, here are some important factors you should consider:

- Interest Rates

- Interest rates on student loans in India can range from 7% to 15%, depending on the lender and the type of loan.

- Repayment Terms

- Ensure that the repayment terms align with your future financial situation. Some lenders offer a grace period, while others may require you to begin repayment immediately after the loan is disbursed.

- Loan Tenure

- The tenure for a student loan can vary, but it generally ranges from 5 to 15 years. Choose a loan tenure that balances monthly repayments with your future earning potential.

- Processing Fees

- Some lenders charge a processing fee for disbursing the loan. This fee can vary from 1% to 2% of the loan amount.

- Collateral Requirements

- For larger loan amounts, especially loans above ₹7.5 lakh, lenders may require collateral (like property, fixed deposits, or insurance policies) as security.

Student Loan Providers in India: A Comparison

There are numerous options when it comes to student loans in India. To make your decision easier, here’s a comparison of some of the top student loan providers:

| Bank/Institution | Interest Rate | Loan Amount | Repayment Tenure | Collateral Requirement |

|---|---|---|---|---|

| State Bank of India (SBI) | 7.9% – 9.9% | ₹10 lakh (Domestic) | 15 years | Required for loans above ₹7.5 lakh |

| HDFC Bank | 9.5% – 11.5% | ₹20 lakh (Foreign) | 15 years | Yes, for loans above ₹7.5 lakh |

| ICICI Bank | 9.7% – 11.5% | ₹20 lakh (Domestic) | 15 years | Yes, for loans above ₹7.5 lakh |

| Axis Bank | 10% – 11.5% | ₹20 lakh (Domestic) | 12 years | Yes, for loans above ₹7.5 lakh |

| Punjab National Bank (PNB) | 8.8% – 9.5% | ₹20 lakh (Domestic) | 15 years | Required for loans above ₹7.5 lakh |

| Bank of Baroda | 8.3% – 9.9% | ₹20 lakh (Domestic) | 15 years | Required for loans above ₹7.5 lakh |

.

Documents Required for Student Loan Application

The documents you need to submit for a student loan application typically include:

- Proof of Identity (Aadhaar card, passport, voter ID)

- Proof of Address (Aadhaar card, utility bills, rental agreement)

- Admission Letter (from the educational institution)

- Academic Records (mark sheets, certificates)

- Co-Applicant’s Documents (Income proof, bank statements, identity proof)

Common Challenges and How to Overcome Them

While student loans can provide much-needed financial support, they also come with challenges:

- High-Interest Rates

- Some lenders may offer high-interest rates, especially for education loans for foreign studies. It’s essential to compare interest rates across different lenders before applying.

- Repayment After Course Completion

- Managing loan repayment can be tough, especially for students who face delays in securing jobs. Look for loans that offer longer moratorium periods to give yourself more time before repayments begin.

- Collateral Requirements

- If your loan amount exceeds ₹7.5 lakh, you may need to provide collateral. If you don’t have valuable assets to offer, consider looking for unsecured loans.

Conclusion

Student loans are a great way for Indian students to fund their education, but it’s essential to be fully aware of the terms and conditions before committing to a loan. In 2026, the process is smoother than ever, with a range of options available to suit different needs. By choosing the right lender, understanding eligibility criteria, and comparing loan terms, you can make an informed decision that ensures financial stability throughout your academic journey and beyond.